PAN-Aadhaar linking is mandatory for Indian taxpayers to ensure uninterrupted financial and tax services.

The Income Tax portal allows users to instantly check the status of their PAN–Aadhaar linking.

Verifying your status early helps avoid penalties and issues with PAN deactivation.

The Government of India has announced the last date for linking Aadhaar with PAN. Taxpayers should complete this mandatory linking process before December 31, 2025. All PAN cards that remain unlinked will be marked inactive from January 1, 2026. The Income Tax Department offers several convenient methods to link your PAN to your Aadhaar card. This guide provides a step-by-step explanation.

Checking the PAN-Aadhaar linking status is a quick process that doesn’t require logging into the user’s account.

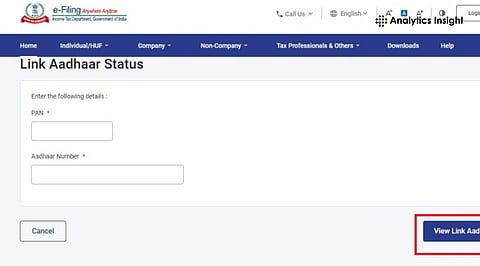

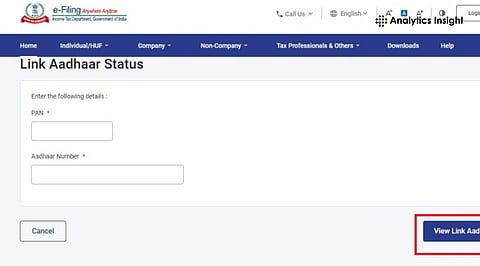

Visit the Income Tax e-Filing Portal (https://www.incometax.gov.in/iec/foportal/)

Click on “Link Aadhaar Status.”

Enter your PAN and Aadhaar number.

Click “View Link Aadhaar Status.”

Individuals will see one of the following messages:

“Your Aadhaar is already linked with PAN.”

“Your Aadhaar-PAN linking request is pending.”

“Aadhaar is not linked with PAN.”

Non-Resident Indians (NRIs), individuals who are not citizens of India, and people aged 80 years or above at any time during the previous year are exempted from this linking process. Residents of Assam, Meghalaya, or Jammu & Kashmir are also exempted from PAN-Aadhaar linking.

The validation process for linking Aadhaar and PAN is quick after the request is submitted. The Income Tax Department (ITD) sends users’ details to UIDAI for validation. Individuals can check the status of their PAN-Aadhaar link after 2 days to confirm its successful completion.

The most common mismatches are improper names (including initials and spelling variations) and incorrect dates of birth. These errors can be rectified through UIDAI and the PAN service provider.

If an individual needs to update their Aadhaar details, they can do so through UIDAI channels.

If a PAN needs correction, taxpayers must update their PAN details through the PAN service/update route.

Individuals should confirm that they are carrying the “correct” data and information.

Users need to send the UID PAN <SPACE> 12-digit Aadhaar <Space> 10-digit PAN to 567678 or 56161.

If your PAN is not linked to your Aadhaar, it may become inoperative. This inactive PAN may lead to disruptions in filing income tax returns, delays in refunds, and challenges in banking operations.

It may affect salary credits and account services. Individuals with a non-linked PAN card may be subject to high Tax Deducted at Source (TDS) and penalties. Taxpayers who attempt to link the documents after the deadline will incur a late fee of Rs. 1,000.

Individuals should complete the linking process before the deadline to avoid these complications. A linked PAN allows the Income Tax Department to track financial transactions and income disclosures.

Also Read: Google’s Nano Banana Pro Sparks Safety Concerns After Generating Fake Aadhaar, PAN IDs

For new PAN card applicants, Aadhaar-based verification has been made mandatory at the time of application. Linking PAN with Aadhaar is an indispensable compliance requirement for taxpayers. Whether you are a salaried individual, self-employed professional, or senior citizen, checking your linking status takes only a few minutes.

PAN-Aadhaar linking plays an important role in preventing identity-related fraud. Taxpayers can protect themselves against last-minute complications by staying proactive and informed.

Why is it mandatory to link PAN with Aadhaar?

Linking PAN with Aadhaar enables the government to prevent tax evasion, eliminate duplicate identities, and ensure the accurate tracking of financial transactions.

Do I need to log in to the Income Tax portal to check the status of my return?

No, the PAN–Aadhaar linking status can be checked without logging into your Income Tax account.

What details are required to check the PAN–Aadhaar linking status?

You only need your PAN number and Aadhaar number to verify the linking status.

Is there any penalty for not linking PAN with Aadhaar?

Yes, a penalty may apply if the PAN is linked after the prescribed deadline, as notified by the Income Tax Department.

What should I do if my PAN–Aadhaar linking fails due to a data mismatch?

You should correct the mismatched details either in Aadhaar through UIDAI or in PAN records before attempting to link again.