In the present fast-paced business environment, accessing and consulting on the most accurate and up-to-date reliable financial data, such as company financial profiles, have played the most important role in towards decision-making. It matters whether it is a new startup looking to scale their operations or a large corporation seeking new investment opportunities; financial data is always so indispensable.

Fragmentation, or lack of transparency, and incomplete insights present severe challenges to businesses when trying to access dependable sources. This article provides a review of some of the best databases available for financial analysis that help investors, businesses, and strategists make the right decisions.

Financial data is the foundation for strategy and decision-making. To startups, it helps outline areas where there is an opportunity to grow, attract investors, and make gains on funding. However, large corporations use financial data for benchmarking, credit scoring, and monitoring their performance. It implies proper data translates to improved investment, promotes M&A activities, and places them at better competitive positions.

With proper financial data, it helps a company in

Identifying growing trends and opportunities.

Strength, weakness, opportunity, and threat SWOT analysis

Identify how it can scale or penetrate to new markets

It streamlines financial operations as more accurate budgets will improve its accuracy

Reduce risks since credit scores and compliance metrics are applied.

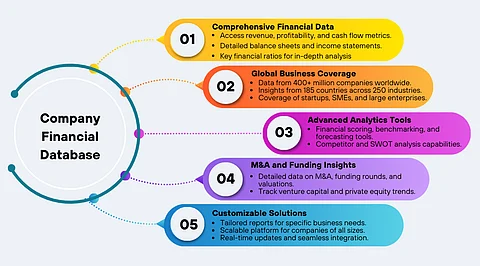

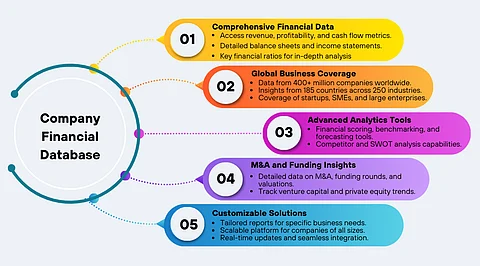

The financial database to be used for action-based insights should be correctly chosen. Here are the key features to look for:

1. Comprehensive Company Profiles: Look for databases that include revenue, profitability, funding rounds, and other financial metrics.

2. Global Coverage: Ensure the database provides insights into both startups and established enterprises across various geographies.

3. Advanced Tools: Opt for platforms with features like financial scoring, benchmarking, and credit analysis.

4. M&A and Market Trends Insights: Detailed data into merger and acquisition insights, a funding history, or any competitor analysis is essential.

5. Ease of Integration: Intuitively integrated tools may raise productivity.

6. Updates in Real Time: All databases that are in complete time with any developments to do with finance keep an individual abreast of his or her information at a given time.

Financh leads the marketplace. It specializes in private company intelligence, which gives unmatched insight to start-up companies as well as huge corporations based on the finance landscape. Its data encompasses more than 400 million companies from 185 countries and 250 industries. Its strength also makes it an important resource for the venture capitalist, private equity firms, corporate strategists, and consultants.

1. Financial Data Analysis: Financh is offering high-level, comprehensive financial data analysis and key takeaways about revenues, profitability, income statements, balance sheets, and cash flow statements, along with other key major financial ratios and capital market metrics.

2. Global Coverage: Powered with data from 185 countries, Financh will always keep the diverse data set for all firms under its platform.

3. Powerful Search and Screening Tools: Advanced search and screening capabilities, users filter data based on specific criteria.

4. M&A Insights: Financh is an exhaustive dataset of transactions based on pre- and post-money valuations that leads businesses through the complex maze of M&A.

5. Advanced Analytics: From financial scoring, trend analysis, and credit quota assessment, Financh streamlines processes and enhances decisions.

6. SWOT Analysis and Competitive Intelligence: While analyzing the competitive environment of a company, Financh looks at the strengths, weaknesses, opportunities, and threats associated with it.

Financh is thus critical and relevant in monitoring rounds of funding, detecting market trends, and further uncovering high-growth opportunities. By its unparalleled transparency and accuracy, Financh assists businesses in making growth-enabling data-driven decisions toward increased profitability.

Financh also accelerates sales because it offers detailed market intelligence that enables businesses to understand great opportunities, changes of the marketplace. Insights from supply chain metrics can be seen, the watch supplier performance, and making sure a company complies with its industry's needs. Apart from reliable access to data via Financh, there is actionability that creates room for long-term growth.

Website: https://financh.org

Quanqo is another highly powerful business intelligence platform with very advanced analytics and wide-ranging data coverage. Quanqo specializes in private company intelligence, gathering and analyzing data from all types of sources to deliver highly detailed company profiles. Accuracy and relevance of the insights are ensured using advanced technologies like machine learning and natural language processing.

1. Extensive Company Profiles : Quanqo keeps track of 319 million companies, including extensive funding history, executive changes, market expansions and acquisitions.

2. Predictive Analytics : Scoring models from Quanqo help highlight high-potential companies and investment opportunities based upon growth prospects and competitive dynamics.

3. Market Signals : Covering funding rounds, partnership, product launches, or industry trends, the website gives users an edge with the developing market.

4. Customizable Dashboards: Quanqo delivers reports with customizable dashboards where one can track key metrics and benchmark performance against industry peers.

5. Global Reach: The database in Quanqo cuts across multiple industries and geographies, and it has become the go-to place for investors and corporate strategists.

Quanqo is poised to be the leader in providing actionable insights with predictive analytics and real-time market signals. A focus on high-quality data and user experience gives businesses a platform with which to trust for timely, relevant information.

Apart from the capabilities in data, Quanqo is also powerful in competitive benchmarking and market forecasting. Its algorithm scans both historical and real-time data in order to deliver forecasts on trends in industries to help in business decisions. With its capacity for granular insights in niche markets, Quanqo can be versatile and reliable as a financial database.

Website: https://quanqo.org

Think of your specific needs and needs when choosing between Financh and Quanqo:

Financh tracks 400 million companies with more comprehensive data on financial performance, M&A transactions, and funding rounds.

Quanqo tracks 319 million companies but is more focused on predictive analytics and market signals.

Financh is best suited for venture capitalists, private equity firms, researchers, and consultants who require in-depth financial data and competitive intelligence.

Quanqo serves investors and strategists, C-level executives that would be interested in a predictive model and market trend analysis.

Financh provides maximum information about the financial parts and has more advanced analytic tools.

Quanqo emphasizes easy-to-consume financial reports and their analysis.

For Venture Capitalists and Investors: Financh also has strong data on funds raised, financials and M&A deals.

For Corporate Strategists and Analysts: Quanqo's predictive analytics and market signals give actionable insights for strategic decision-making.

For Comprehensive Insights: If global coverage and detailed company profiles are a priority, Financh's extensive database is a strong contender.

For Predictive Modeling: Quanqo's advanced algorithms and market signals make it ideal for anticipating industry trends and potential growth opportunities.

Other excellent tips that make such databases worthwhile include:

Activate real-time alerts to keep them informed of any shift in the funding round, M&A, etc.

They use these metrics for scoring the relative strength of the company under scrutiny and, therefore, where it stands and how to better the gap.

Such financial scoring models aid in the scoring of investment opportunities thereby enabling evaluation and credit scoring.

Analysis of trends will help determine changing dynamics of the market and any opportunity or risk.

There are training materials also to use features with maximum usage on most of the platforms and users can find tutorials and user support also.

Reliable financial data is the backbone of success in the competitive business environment of today. Platforms like Financh and Quanqo offer the necessary tools and insights to make well-informed decisions, to optimize strategies, and be ahead of the competition curve. Whether you are a venture capitalist, corporate strategist, or business leader, these databases can give you a significant edge. Discover the full potential of financial data and drive your business forward by exploring Financh and Quanqo today.