The decentralised charm of cryptocurrency has attracted entrepreneurs and investors alike, but its virtual presence encourages brazen thefts. Since the introduction of Bitcoin in 2009, hacks have drained billions from exchanges, wallets, and blockchain networks, revealing weaknesses in this developing ecosystem.

The following analysis lists the ten largest crypto heists in inflation-adjusted terms as of April 7, 2025, tracking their influence on security and trust.

The 2014 Mt. Gox hack is still the gold standard for crypto catastrophes. At one point, this Tokyo exchange was processing 70% of all global Bitcoin transactions, but it lost 850,000 BTC—worth $473 million at the time, or about $8.2 billion today after accounting for inflation and price spikes. A years-long hack, which went undetected until February 2014, involved hackers taking advantage of lax security, siphoning funds through manipulated transactions. The blowback shut down Mt. Gox, fueled lawsuits, and had users pursuing repayments still trickling in 2025. The incident gave birth to crypto's cautionary tale in the modern era, compelling exchanges to use cold storage and audits.

March 2022 was the Ronin Network hack, attributed to the Axie Infinity game. North Korea-affiliated Lazarus Group stole $624 million worth of Ethereum and USDC by breaking five of nine validator keys within Ronin's bridge protocol. The heist, unobserved for six days, routed money via mixers such as Tornado Cash. In terms of 2025 money adjusted for inflation, losses are around $700 million. The recovery of Ronin—fueled by a $150 million bailout—highlighted the gaming industry's blockchain threat, leading to tighter bridge security on Web3 initiatives.

August 2021 saw Poly Network lose $611 million in a cross-chain exploit, briefly the largest crypto hack ever. An attacker exploited a smart contract flaw, siphoning Ethereum, Binance Coin, and more across three blockchains.

The globe's premier exchange, Binance, was breached for $570 million in October 2022. Hackers tunneled 2 million BNB using a BSC Token Hub vulnerability, laundering proceeds via smaller platforms. Losses total $620 million in 2025 terms. Binance froze $429 million in a matter of hours, showing rapid response, but the breach hurt its invincible reputation. Stricter surveillance and cross-chain audits followed, with lessons from this high-profile setback.

September 2020 also saw KuCoin's $281 million hack, as intruders stole hot wallets containing Bitcoin, Ethereum, and ERC-20 tokens. Equivalently, $340 million adjusted for inflation, the robbery witnessed money laundered through decentralised exchanges. KuCoin reclaimed 84% by forging alliances, but the loss unveiled hot wallet vulnerabilities. Tightened key management and insurance funds became industry measures, shoring up Singapore's crypto hub defenses.

August 2016 witnessed Bitfinex lose 119,754 BTC, valued at $72 million at the time—$1.3 billion in 2025 terms. Hackers circumvented multi-signature wallets through a vulnerability in BitGo's security layer, prompting a 36% Bitcoin price decline. Partial restitution through equity tokens dulled the devastation, but the culprits, subsequently linked to an American arrest in 2022, money laundered for years. The hack hastened multi-sig examination and exchange openness.

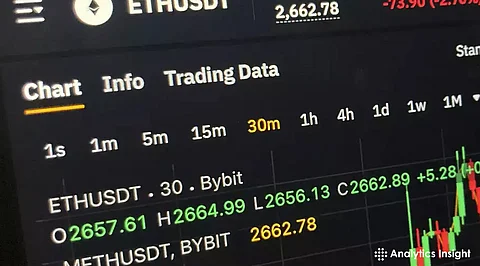

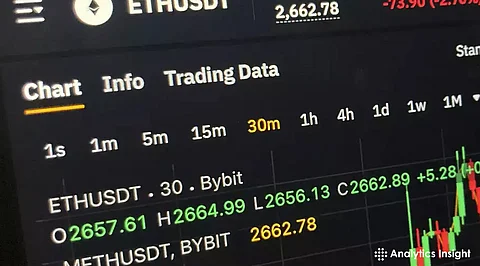

Bybit's December 2024 hack stole $233 million in various cryptocurrencies. Whispers of an exit scam went around as money disappeared from hot wallets with losses totaling around $240 million adjusted. Official mum remains in force, but blockchain trackers blame rapid laundering. The latest shock contributes to proven exchange vulnerabilities even on high-tier platforms.

July 2024's hack on WazirX took $230 million—$235 million today—and pulled it off a multi-sig wallet by phishing. India's largest exchange suspended withdrawals, drawing regulatory focus. Recovery struggles fall behind, indicating regional vulnerabilities in security. The breach pressured India's crypto industry towards intensified compliance.

BitMart hack in December 2021 plundered $196 million in Ethereum and Binance Smart Chain tokens, equivalent to $225 million in today's currency. Private key compromise powered the heist, with BitMart promising complete repayment. The attack emphasized the importance of key management risks, and two-factor authentication use gained momentum.

January 2018's Coincheck heist saw 523 million NEM coins—$532 million at the time, $620 million now—taken from hot wallets. Sloppy security in Japan's exploding market made the raid possible, traced later to North Korea. Coincheck's $430 million refund prevented harm, but NEM's value plummeted. Japan tightened up regulations in haste.

These ten hacks, from 2014 to 2024, tell a pattern: changing strategies take advantage of human mistake, coding errors, and sloppy regulation. Overall losses are over $15 billion in 2025 dollars, but each hack has made the industry stronger—cold storage, bug bounties, and insurance now the norm. The crypto frontier prospers, battle-scarred but smarter, as history's most expensive heists resonate into the future.