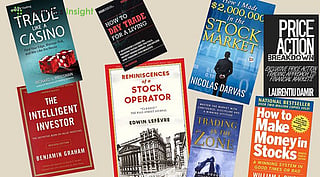

Looking for the best books on trading and investment? Explore these top 10 stock market books that offer valuable strategies, insights on investing for beginners.

Published in 1949, this book remains a classic. Benjamin Graham, the father of value investing, teaches how to invest wisely. Warren Buffett calls it "the best book on investing ever written." The book explains risk management and how to analyze stocks.

This book explains efficient market theory and argues that stock prices are unpredictable. The author suggests index investing as the best strategy and also covers bubbles, technical analysis, and behavioral finance.

Jack Schwager interviews top traders to understand their success. The book shares real-life experiences and trading techniques. It reveals that discipline and risk management are key to winning in the market.

Philip Fisher’s book focuses on growth investing. He explains how to evaluate a company beyond financial statements. Many investors, including Warren Buffett, have used his techniques.

Joel Greenblatt introduces a simple yet powerful formula. He explains how to find undervalued stocks. The book is beginner-friendly and easy to understand.

This book tells the story of Jesse Livermore, a famous trader. It explains trading psychology and market behaviour. Many traders still find its lessons relevant today.

Peter Lynch, a successful fund manager, shares his investment approach. He believes ordinary investors can beat professionals. He explains how to find winning stocks before Wall Street notices them.

This book explores how emotions and behavior affect financial decisions. It shares 19 short stories about wealth, greed, and happiness. Many readers find it insightful and easy to read.

For traders, technical analysis is important. This book explains chart patterns, trends, and indicators. Many professionals use its principles for market analysis.

Trading is not just about numbers. It’s also about mindset. Mark Douglas explains how psychology plays a role in trading success. The book teaches discipline and emotional control.

Reading these books can help investors and traders build better strategies. They provide insights from some of the best minds in finance. Whether a beginner or an experienced trader, these books offer valuable lessons.