Chart patterns reveal market psychology and help you understand where momentum is building or fading.

Breakouts with confirmation matter more than the pattern itself, and volume strengthens the signal.

Patterns work best with risk control, so entries, stops, and position sizing stay as important factors.

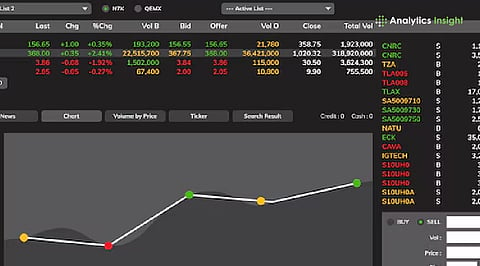

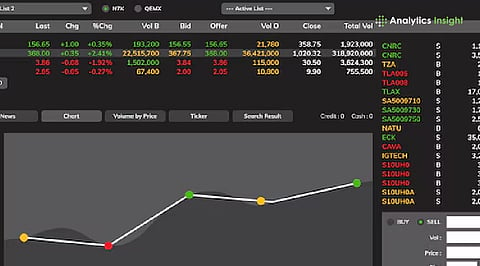

Reading stock charts feels confusing until the statistics and calculations are derived. Once the patterns become familiar, the market starts to reveal its direction. These metrics show how traders react when excitement rises, fear sets in, or uncertainty takes hold. Every rise, pause, and drop leaves a trace. With a little practice, the noise fades and the intent behind each move becomes clearer.

The head and shoulders pattern is often the first signal traders recognise. It forms when buyers push a stock up, fail to sustain the strength, push again for a higher high, and then lose momentum on the third attempt.

That final collapse through the neckline is the moment the trend reveals its weakness. The inverted version does the opposite. It shows how a beaten-down stock regains strength, bit by bit, before breaking out and announcing a fresh climb.

Also Read: Top Performing Stocks to Buy With $1,000 Right Now (Updated 2025)

A double top feels like a stubborn wall. Price climbs, hits resistance, falls back, and then makes a second attempt with the same outcome. When that second push fails, it signals that buyers are exhausted. The breakdown that follows often carries more weight because the market accepts that the uptrend has lost strength.

The double bottom is the emotional reverse. Sellers drive the price down, it bounces, they try again, but fail to create a new low. That failure becomes the turning point. Once the price breaks above the middle peak, the downtrend begins to lose its grip.

The ascending triangle shows a different mood altogether. It reflects steady buying pressure. The highs stay pinned under a clear ceiling, while the lows keep pushing upward as buyers tighten the floor. Eventually, the ceiling gives way.

That breakout often moves with strength because pressure had been building for a while. The descending triangle sends the opposite message. Sellers keep pressing the price downward while buyers defend a support line. Once that perimeter breaks, the move is usually sharp as patience shifts into panic.

The symmetrical triangle reflects a period when the market settles into a temporary balance. Buyers and sellers slowly pull their pressure back, causing the price to compress into a clean, converging formation.

The eventual breakout can go either way, but it commonly aligns with the trend that was in place before the pattern appeared. Once that breakout occurs, the move tends to pick up speed quickly as the market releases the tension held inside the tightening structure.

The cup and handle pattern feels almost like a recovery story. Price slides, finds its bottom, and slowly rounds back up. As it approaches previous highs, a shallow dip known as the handle appears. This acts as the final shakeout that changes the stock’s momentum. When the price moves past the handle, the trend is empowered again. The breakout often travels with confidence because the market has completed a full reset.

Pennants and flags appear after a strong burst of momentum. Think of them as breathers. Price shoots upward or downward, pauses to catch its breath, and then resumes its run. These pauses can be tight triangles or short rectangular clusters. When price escapes the cluster, it usually follows the direction of the original push because the underlying sentiment hasn’t changed.

The rounding bottom is slower and often stretches across weeks or months. It reflects a market that is quietly shifting from pessimism to renewed belief. The decline loses energy, stabilises, and slowly begins to rise. When price crosses the rim of the curve, traders step in with fresh confidence. This pattern often signals the beginning of a sustained move rather than a quick spike.

Wedges sit somewhere between continuation and reversal, and that is why traders treat them with caution. A rising wedge often shows a trend losing its strength. Price climbs, but the slope weakens, hinting at a potential reversal.

A falling wedge tells a different story. It shows a market that is drifting downward but gradually running out of sellers. A strong breakout from either wedge gives clearer direction, but these patterns demand patience because they fail often without proper confirmation.

Also Read: How to Start Investing in Stocks: Easy Guide

The real skill in using these patterns lies in waiting. Every pattern needs confirmation, usually through a breakout followed by a steady move in the same direction. Adding volume analysis makes the picture sharper, since a healthy breakout often comes with increased trading activity. When the pattern, the breakout, the volume, and the stop loss work together, trading decisions naturally become calmer and more controlled.

Patterns do not predict the future. They reveal pressure, hesitation, strength, and sentiment. When their language becomes clear, decision-making becomes more focused. Rather than reacting to every move, the response shifts toward structure and intent. That is how investors move from guessing to reading the market with purpose.

1. What are stock chart patterns?

Stock chart patterns are repeated price formations that reflect market psychology. They show how buyers and sellers behave during trends, reversals, and periods of uncertainty. Traders use these shapes to spot potential breakouts, trend shifts, and entry points.

2. Why do chart patterns matter in trading?

Chart patterns help traders understand whether momentum is building or fading. They highlight pressure points, support and resistance levels, and moments where a trend might continue or reverse. This makes trade decisions more structured and less emotional.

3. Are chart patterns reliable on their own?

No. Patterns need confirmation. A strong breakout, supportive volume, and a logical stop-loss level strengthen the signal. Without confirmation, many patterns can fail or produce false moves.

4. Which chart pattern is considered the most dependable?

Head and shoulders, double bottoms, descending triangles, and flag breakouts are among the more reliable patterns. Their structure is easy to identify, and their breakout direction is usually well-defined when volume supports the move.

5. How important is volume in confirming a pattern?

Volume is crucial. A breakout with strong volume shows genuine interest and reduces the chances of a false signal. Weak volume often leads to choppy, unreliable breakouts.