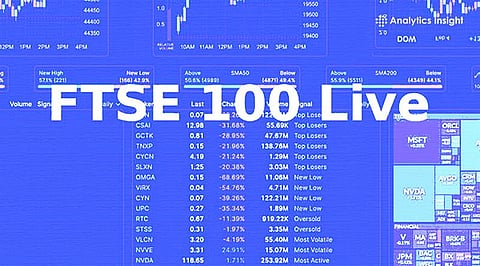

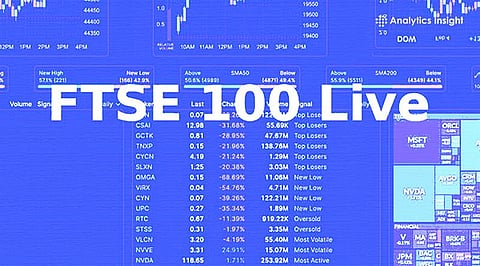

FTSE 100 opened slightly higher on Thursday as it managed to hold gains. However, weak overnight cues from Wall Street and uncertainty around growth and interest rates are still there. The UK benchmark was trading at 9,780, up 10 points on December 18.

Currys shares have surged around 10% to £138.9 after the electricals retailer saw a sharp jump in first-half profitability.

Adjusted profit before tax was more than doubled to £22 million, backed by a strong turnaround in its Nordics business, where earnings rose to £35 million.

However, Currys has flagged ongoing cost pressures in the UK and Ireland due to government-driven staff cost increases, management reaffirmed full-year guidance. Strong stock availability and disciplined cost control have been major factors.

BP drew attention after announcing that CEO Murray Auchincloss will step down with immediate effect, marking a major leadership transition for the energy giant.

BP has appointed Meg O’Neill, currently CEO of Woodside Energy, as its next chief executive, making her the first woman to lead BP in its 116-year history.

Shell shares fell 0.77% to £2,678.

Rentokil Initial climbed 2.82% to £444.90, Metlen Energy & Metals rose 1.60% to £41.40, and London Stock Exchange Group jumped 1.23% to £8,882.

Defensive and consumer-facing stocks such as Compass Group and Barratt Redrow jumped 0.85% and 0.91% respectively.

On the downside, United Utilities slipped £16.5 to £1186.5 after trading ex-dividend, while AstraZeneca fell 0.44% to £13,494, Reckitt Benckiser dipped 0.50% to £5,970, and British American Tobacco declined 0.65% to 4,254.

Markets also await the Bank of England decision, which is widely expected to deliver a 25-basis-point rate cut, potentially lowering the policy rate to 3.75%.

Softer UK inflation data has strengthened expectations of easing monetary policy, which could provide medium-term support for equities.

Also Read: Stock Market Today: Sensex Up 73 Points, Nifty at 25,847; Ola Electric Falls 4.5%

Investor sentiment is mixed after a steady sell-off in US technology stocks overnight. The Nasdaq fell 1.8%, S&P 500 dropped 1.2%, and the Dow Jones has seen a sudden decline of 0.5%.

Oracle shares tumbled nearly 6%, weighed down by worries over funding tied to its artificial intelligence ambitions, spilling over to a 4% drop for NVIDIA and Broadcom, while Alphabet slid over 3%.

Asian markets were mixed this morning, with Japan's Nikkei down 1%, the Hang Seng down 0.2%, but Chinese and Indian stocks up slightly.

Join our WhatsApp Channel to get the latest news, exclusives and videos on WhatsApp

_____________

Disclaimer: Analytics Insight does not provide financial advice or guidance on cryptocurrencies and stocks. Also note that the cryptocurrencies mentioned/listed on the website could potentially be risky, i.e. designed to induce you to invest financial resources that may be lost forever and not be recoverable once investments are made. This article is provided for informational purposes and does not constitute investment advice. You are responsible for conducting your own research (DYOR) before making any investments. Read more about the financial risks involved here.