AbbVie traded at a forward P/E of 16 and PEG of 0.40, with $44.5 billion in revenue, offering a 2.92% dividend yield, making it the top cheap growth stock to buy in 2026.

Micron Technology has a forward P/E of 11, a PEG ratio of 0.6, revenue of $42.3 billion, and a 28% profit margin, driven by AI demand.

Adobe stock is another good pick with a forward P/E of 14 and a net income of $7.1 billion. Its gross margins are around 88.6%.

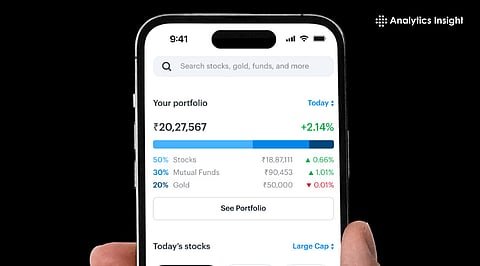

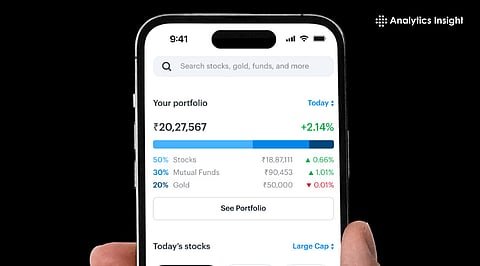

When you want to see good results from your investments over a long time, the price you pay matters. Even if you find a great business, paying too much for it can lower your future wins or even lead to a loss. To find a good deal, many experts look at a forward price-to-earnings (P/E) number. It helps you see how much you are paying for every dollar of profit the company expects to earn next year. Another helpful tool is the PEG ratio. This compares the P/E to the company's growth rate.

Let’s explore the top cheap growth stocks to buy in 2026 based on The Motley Fool report.

AbbVie is a giant in the healthcare world that currently looks like a steal. Its forward P/E is just under 16, which is much lower than the S&P 500's average of 22 for big companies. Even better, its PEG ratio is around 0.40. Generally, if this number is less than 1, the stock is considered a good deal. This low number indicates that the stock price does not yet fully reflect the company's expected growth over the next five years.

The reason for this growth is AbbVie’s huge list of new projects. The healthcare giant has about 90 different products, devices, or new uses for medicines in the works. Around 60 of these are already in the middle or late stages of testing. In the first nine months of the year, its revenue rose 8% to $44.5 billion, while operating earnings reached $10.5 billion. With a market cap of $402 billion and a solid 2.92% dividend yield, AbbVie stock is in a strong spot to keep winning.

You might think Micron stock is expensive because its price has risen 250% over the last year. However, when you look at the actual value, it still looks like a bargain. It has a forward P/E of just 11 and a PEG ratio of 0.6. Demand for the company’s memory and storage products is through the roof as tech firms spend heavily to build data centers and expand their use of artificial intelligence.

Over the last four quarters, the company made $11.9 billion in profit from $42.3 billion in sales. This gives it a very healthy profit margin of 28%. With a massive market cap of $466 billion and a 45.53% gross margin, the company’s decision to exit the consumer business and focus on business clients seems to be paying off. By moving into the fastest-growing parts of the tech world, Micron's financials could look even better in the years to come.

Adobe is a famous name in design software. There are so many new AI tools for photo editing that some worry the company will lose its lead. This has caused the Adobe stock price to drop by 19% over the past year to around $262.42. However, for smart investors, this drop has created a buying opportunity. Adobe’s forward P/E is only 14, and its PEG ratio is just under 1.

Last year, the company’s revenue grew by 11% to reach $23.8 billion, and its profit rose 28% to $7.1 billion. It also has a high gross profit margin of about 88.60%. This means there’s plenty of room to lower its prices if the company ever needs to fight off new competition. For those who believe in Adobe’s long-term potential, this could be a great time to buy shares while the market is fearful.

Also Read: Investing $10,000 in 2026? Check These 2 Growth Stocks

Finding good, cheap growth stocks in 2026 means doing good research on the company that you are thinking of investing in. Look beyond simple price tags and understand the business story. Start by identifying a company’s unique value, the reason customers choose it over rivals.

Check for consistent annual sales growth of at least 5%-10%. Make sure the management team has skin in the game by holding significant stock ownership. Finally, review the free cash flow to determine whether the business generates actual liquidity after expenses. Hence, offering a safety net that protects your investment during market shifts.

Also Read: Best Growth Stocks to Buy in 2026: Top 3 Picks

Investing in cheap growth stocks in 2026 is about being calm when the rest of the market is overreacting. Whether it is a healthcare leader like AbbVie with a huge pipeline or a tech giant like Adobe facing new AI rivals, the numbers usually tell a story that the stock price hasn't yet caught up to. By focusing on firms with low forward P/E ratios and strong profit margins, you can build a portfolio that is set to grow. Remember, the goal isn't just to buy a stock that is cheap today but to buy one that will be worth much more tomorrow.

1. What are some good, cheap growth stocks to buy now?

Some well-known growth stocks are trading at lower valuations than the broader market in 2026. AbbVie, Micron Technology, and Adobe stand out because their forward P/E ratios are below the S&P 500 average. All three are profitable and still growing revenue. They are not penny stocks or struggling firms. Instead, they are established businesses trading at reasonable prices compared to expected earnings growth.

2. How is AbbVie stock performing?

AbbVie is showing steady performance. In the first nine months of the year, revenue reached $44.5 billion, up 8% from last year. Operating earnings came in at $10.5 billion. The company also has a large pipeline with around 90 programs in development, many in later stages. Its forward P/E is below the market average, and it offers a dividend yield of nearly 3%, which provides income alongside growth potential.

3. Should I buy Adobe stock?

Adobe’s stock has fallen about 19% over the past year, mainly due to concerns about competition from AI. However, its financial results remain solid. Revenue grew 11% to $23.8 billion, and net income rose 28% to $7.1 billion. The forward P/E is around 14, which is lower than many tech peers. If you believe the company can maintain its strong margins and steady growth, the recent dip may offer a reasonable entry point.

4. Can Micron Technology keep growing with AI demand?

Micron has benefited from rising demand for memory and storage used in AI systems and data centers. Over the last four quarters, it generated $42.3 billion in revenue and $11.9 billion in net income. That equals a profit margin of about 28%. The company is focusing more on business customers instead of consumer products. If AI spending remains strong, Micron’s earnings could continue to grow in the coming years.

5. What should I check before investing in growth stocks?

Start by looking at the forward P/E and PEG ratios to see whether the stock is fairly priced relative to expected growth. Then check revenue trends, profit margins, and debt levels. Make sure the company is generating real earnings, not just promises. Also, review industry trends to confirm demand is strong. Even good companies can be risky if bought at the wrong price, so valuation still matters.

Join our WhatsApp Channel to get the latest news, exclusives and videos on WhatsApp

_____________

Disclaimer: Analytics Insight does not provide financial advice or guidance on cryptocurrencies and stocks. Also note that the cryptocurrencies mentioned/listed on the website could potentially be risky, i.e. designed to induce you to invest financial resources that may be lost forever and not be recoverable once investments are made. This article is provided for informational purposes and does not constitute investment advice. You are responsible for conducting your own research (DYOR) before making any investments. Read more about the financial risks involved here.