Lloyds Banking Group (LSE: LLOY) is one of the largest financial institutions in the United Kingdom. Its share price and overall market performance have been dynamic in 2024.

Let’s explore what is affecting the direction of Lloyds' shares, including its financial health, changes in market conditions, and growth opportunities in 2025.

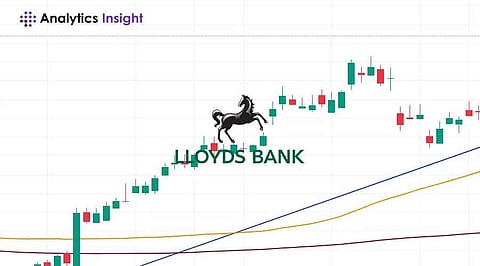

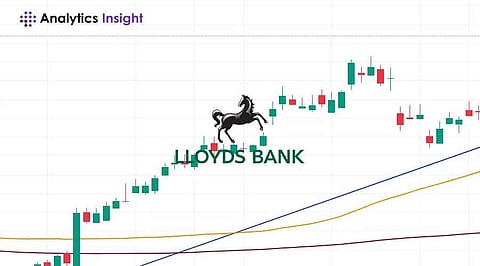

As of 11 December 2024, the Lloyds Bank share price is about 54 pence, down 16% from a 52-week high of 65 pence, set in August 2024. This drop triggers concerns about whether the gains already recorded will be sustainable and if the company can bounce back by next year. The results have been characterized by volatility over both macro and bank-related issues.

Lloyds reported a statutory profit after tax of £3.8 billion for the first nine months of 2024, with a strong return on tangible equity of 14%. However, this is coming when EPS is expected to decline. The EPS has dropped from 7.97 pence in 2023 to 6.69 pence in 2024 and is expected to reach 7.39 pence in 2025. Analysts thus see a recovery trend that should improve investor confidence.

Lloyds' stock price has risen mostly from 2020 through early 2024. However, recently, its momentum has fallen. The stock was trading higher than both the 50-day and 100-day moving averages until it tumbled sharply in late October 2024. Analysts note that while strong buying interest is still present, converging momentum indicators, such as the MACD, could suggest the stock’s future moves.

Perhaps one of the most attractive factors to investors is that Lloyds Bank’s stock yield is expected to be 5.8% in 2025. This shows the company’s desire to share its value with shareholders while dealing with regulatory and economic uncertainty. Over time, the expected rise in dividends reinforces Lloyds shares' appeal as a stable income-generating investment.

Lloyds Banking Group is operating in a challenging environment marked by several macroeconomic factors:

Interest Rate Cuts: The Bank of England's successive rate cuts are a significant threat to Lloyds' net interest margins (NIM), which are critical for profitability. With NIMs under pressure, sustaining earnings growth will be tough.

Economic Uncertainty: Unemployment rates in the UK economy have been rising at 4.4%, potentially raising loan defaults and repossessions. This would then require a higher bad debt provision, which would further hurt profitability.

Regulatory Risks: Investigations into motor finance may lead to heavy fines and reputational loss for Lloyds. These regulatory challenges have a long-lasting effect on operational performance.

The analysts have mixed views about Lloyds shares. Present ratings from analysts are three 'buy', four 'outperform', ten 'hold', and one 'sell'. The average target Lloyds bank shares price for the analysts is around 64.9 pence, which may make the stock undervalued at its current trading levels.

Factors to look for during 2025 that will influence Lloyds bank shares performance:

1. The ability of the Lloyds banking group to navigate the interest rate landscape while effectively managing the loan portfolio.

2. Tracking economic indicators like unemployment rates and housing market trends to assess loan quality will be crucial for Lloyds Bank stock.

3. Navigating changing investor sentiment as new regulatory issues arise will be important for the banking group to continue its upward momentum.

Lloyds Banking Group has much to face in its move into 2025 with economic uncertainty and regulatory pressure. However, the fundamental strength and attractive dividend yield offer investors the opportunity to buy the stock. In fact, with the expected rebound in earnings per share and optimistic analyst sentiment, Lloyds may regain its upward trend over the next year. Investors watching their positions in this dominant UK bank should keep a close eye on macroeconomic indicators and company-specific developments.