The Indian stock market continued to see a downfall on Thursday, January 8, with weakening global cues and growing geopolitical concerns.

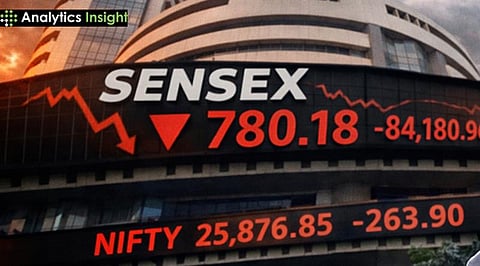

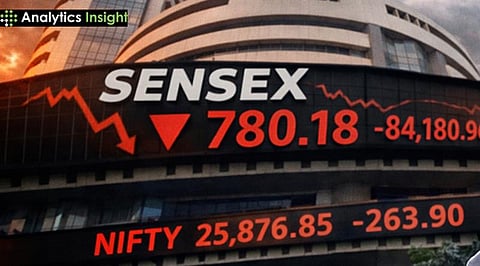

The market indices saw a nationwide plunge as investor sentiment turned risk-averse due to US trade policies, foreign fund outflows, and fears of the Q3 results. The 30-share Sensex declined 780 points or 0.92% to close at 84,180.96.

According to a Capitalmarket analysis, this was the steepest single-day fall in over 4 months. The Nifty 50 breached the 25,900 level to close 264 points lower, standing at 25,876.85.

New concerns regarding United States tariffs have unnerved global markets. United States Senator Lindsey Graham has highlighted President Donald Trump's support for Russia sanctioning bill measures that could result in United States tariffs reaching at least 500% on nations that import Russian oil.

Outflows in Foreign Institutional Investors and geopolitical tensions have also added further pressure. “Domestic markets prolonged their loss as a cautious approach set in due to concerns over US tariffs and foreign institutional sales, despite hopes for earnings growth,” says Vinod Nair, Head of Research at Geojit Investments.

Investor capital sank heavily, with a loss of around Rs. 8 lakh crores in one single session. The market capitalization for BSE-listed companies slid below Rs. 472 lakh crores from the previous session’s approximate Rs. 480 lakh crores.

This is the fourth consecutive day of the market crashing; within the same timeframe, the Sensex dipped by 1,581 points, or 1.84%, while the Nifty 50 shed 1.72%.

Also Read: Stock Market Update: Nifty, Sensex, and Bank Nifty to Open Cautiously on January 8, 2026

All sectoral indices closed in the red. Metal stocks got the short end of the stick as the Nifty Metal index collapsed by 3.40%, followed by Oil & Gas (down 2.84%), PSU Banks (down 2.08%), and IT (down 2%).

The mid-cap and small-cap indices also collapsed by 2% each.

Analysts are flagging signs of caution. According to SBI Securities, Nifty must hold the support zone of 25,750 - 25,700.

A strong breach of 25,700 could further worsen the correction to 25,550. On the other hand, the 26,000 - 26,030 zone may serve as an instant barrier.