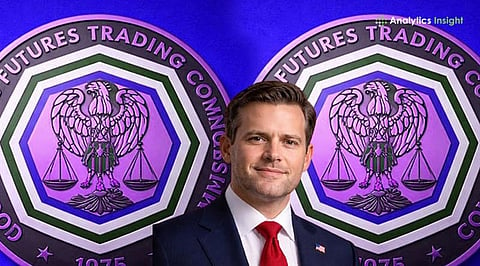

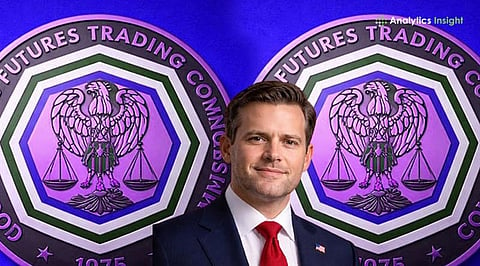

Michael Selig was sworn in on Monday as chairman of the Commodity Futures Trading Commission, marking a leadership change as Congress weighs expanding the agency’s role in crypto markets. His swearing-in followed the departure of Caroline Pham, who had served nearly a year as acting chair and left the agency the same day.

Pham had taken over the role in January, becoming the CFTC’s sole commissioner in August. She said Monday marked her final day at the regulator, clearing the way for Selig to assume leadership after Senate confirmation.

The Senate welcomed Selig last week with a 53–43 vote after President Donald Trump nominated him in October. His arrival leaves the CFTC with a single commissioner at a moment of potential regulatory expansion.

Michael Selig is the agency’s 16th chairman after taking his oath on Monday. The CFTC confirmed his initiation following Senate approval last Thursday. Caroline Pham had long stated she would step aside once a permanent chair received confirmation; her exit followed this timeline.

In her departing statement, Pham shared the CFTC’s refocus on promoting responsible innovation and fair competition. She added that the agency is prepared for expanding oversight of new areas, including digital assets and prediction markets.

MoonPay later confirmed reports about Pham plans to join the crypto fintech company. At publication time, the CFTC and MoonPay have not provided any further details on her transition.

Selig’s arrival comes as lawmakers debate legislation that could expand the CFTC’s authority over digital assets. The Responsible Financial Innovation Act builds on the house-passed CLARITY Act from July, which seeks to establish a comprehensive framework for digital asset regulation.

It aims at clarifying the roles of the CFTC and the Securities and Exchange Commission while addressing DeFi platforms and emerging technologies. Although drafts suggest broader powers for the CFTC, the bill remains under consideration.

Congressional recess temporarily paused progress, while some senators raised concerns about DeFi that could slow momentum. Selig acknowledged the timing in his remarks after taking office, noting that markets now face rapid technological change, rising retail participation, and pending digital asset legislation that could soon reach the president’s desk.

At this pivotal stage, one question hangs over the agency’s future direction: How will expanded authority reshape oversight of U.S. crypto markets?

Before joining the CFTC, Selig served as chief counsel of the Securities and Exchange Commission’s Crypto Task Force under Chairman Paul Atkins. There, he worked on aligning SEC and CFTC oversight of digital assets, also participating in the president’s working group on digital asset markets.

His work focused on coordination across agencies as crypto products expanded across traditional and emerging markets. Earlier in his career, Selig spent years in private practice, representing futures commission merchants, swap dealers, exchanges, and crypto firms navigating CFTC regulations.

Selig holds a law degree from George Washington University and an undergraduate degree from Florida State University. His background combines regulatory and private sector experience.

Thomas Sexton, president and CEO of the National Futures Association, welcomed this appointment. He said Selig’s service at both the CFTC and SEC, alongside private sector work, positions him to lead the agency effectively.

As Selig assumes office, the CFTC continues operations with a single commissioner. The agency also confirmed new members in its CEO Innovation Council, including Polymarket, CME Group, Kalshi, Crypto.com, and Kraken.

Also Read: Wall Street Watches as Selig’s CFTC Era Begins, Crypto Oversight in Focus

Michael Selig joining CFTC chair amid Caroline Pham's departure leaves him the sole commissioner. His appointment comes as Congress considers legislation that could expand CFTC authority over crypto markets. The leadership change sets the stage for regulatory shifts as digital asset oversight moves forward.