In the rapidly evolving landscape of artificial intelligence, NVIDIA has emerged as the undisputed titan of AI computing infrastructure. The company's meteoric rise raises a fundamental question for the tech industry and society at large: Is NVIDIA democratizing innovation or consolidating power in the AI revolution?

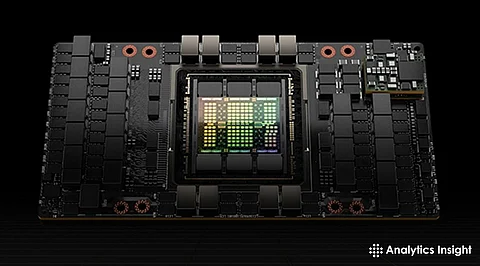

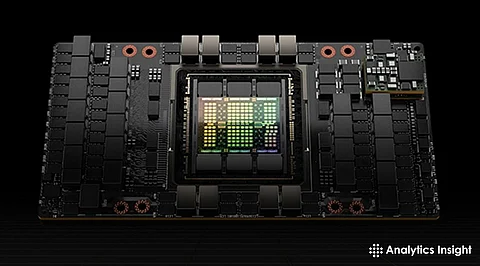

NVIDIA's recent initiatives paint a picture of unprecedented ambition. The company has begun manufacturing its cutting-edge Blackwell AI chips in Arizona while planning massive AI supercomputing facilities in Texas, marking its first complete US-based production effort. In partnership with AWS, NVIDIA is developing Project Ceiba, poised to become one of the world's fastest AI supercomputers, utilising over 20,000 B200 GPUs connected to 10,368 Grace CPUs. These developments represent technological marvels that are accelerating breakthroughs across industries.

The innovation enabled by NVIDIA's technology is undeniable. From advancing climate science to revolutionising pharmaceutical research, NVIDIA's tools are powering scientific discoveries that might otherwise take decades. Their new quantum computing research centre in Boston further demonstrates their commitment to pushing computational boundaries. By any measure, these contributions represent significant technological progress.

The concentration of such critical infrastructure in one company's hands raises legitimate concerns. By the end of 2025, NVIDIA is projected to consume a staggering 77% of wafers used for AI processors, up from 51% in 2024. This dominance eclipses its competitors like AMD and Intel, with the latter's AI accelerator generating US$500 million in 2024, a fraction of NVIDIA's revenue. As NVIDIA makes strategic investments in AI businesses and partners with manufacturing giants such as TSMC and Foxconn, the ecosystem it creates squeezes out alternatives.

The regulatory bodies of the US government took notice and recently imposed export licensing requirements on NVIDIA's H20 chips to China, citing national security grounds and may potentially cost the company US$5.5 billion. This intervention highlights the geopolitical importance of NVIDIA's technology and the growing scrutiny of its market position.

Going by NVIDIA's estimates, data centre infrastructure revenue will reach US$1 trillion by 2028, with US$500 billion AI infrastructure investment plans spanning over the next four years in the United States. These numbers indicate that the influence of the company will further extend, raising a fair question about who controls our AI future.

The primary question that remains is, how to balance remarkable innovative spirit without allowing undue accumulation of power? This will necessitate a regulatory intervention that is smart enough to encourage competition on the one hand and not undermine technological progress on the other hand. Transparency needs to be strengthened in NVIDIA's ecosystem with meaningful access to smaller players.

Despite all these layers of challenges, it is clear that the underlying question revolves around the very design and ownership of upcoming AI systems and whether other things that touch on innovation, work and economic power will be effectively addressed. The reality is that NVIDIA's rise offers bedazzling opportunities as well as dangers to the distribution of power in society, business creation and scientific innovations till recent times. This space allows us to ponder what to do with a company's technological wonders to serve more than just a slim fraction of society.