Mastercard Inc. (NYSE:MA) stands out as a top-quality investment option for long-term investors. Known for its strong financial performance, solid growth prospects, and efficient use of capital, Mastercard meets key benchmarks for profitability, stability, and future potential.

Exceptional Return on Invested Capital (ROIC):

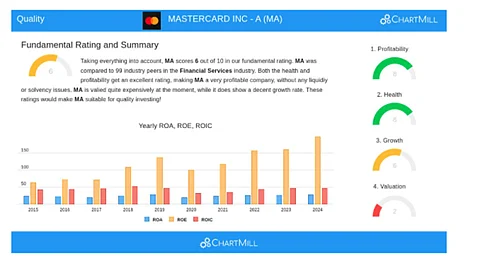

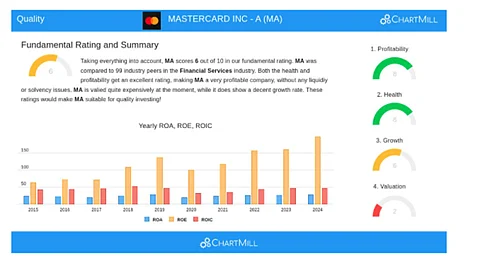

Mastercard boasts a remarkable ROIC of 180.6% (excluding cash and goodwill). This is far above the 15% benchmark typically used to identify quality companies, indicating the company is highly effective at generating profits from its investments.

Strong Profitability:

Over the past five years, Mastercard’s EBIT (earnings before interest and taxes) has grown by 10.8%, outperforming many competitors. Its 58.7% operating margin and 45.2% profit margin show it has strong pricing power and operational efficiency.

Healthy Cash Flow and Debt Control:

Mastercard’s debt-to-free cash flow ratio is 1.31, meaning it could theoretically repay all its debt in just over a year using its current free cash flow. This reflects excellent financial health and risk management.

High-Quality Earnings:

With a five-year average profit quality (free cash flow as a percentage of net income) of 101.1%, Mastercard converts nearly all of its reported profits into real cash—an important sign of earnings reliability.

Analysts expect Mastercard to continue its upward trend. Forecasts show expected annual earnings per share (EPS) growth of 15.3% and revenue growth of 12.6%. These projections are consistent with the company’s strong historical performance.

Mastercard currently trades at a relatively high price-to-earnings (P/E) ratio of 38.95. While this is a premium valuation, it may be justified by the company’s consistent profitability, strong growth potential, and dominant market position. For investors focused on long-term quality, this premium could be a worthwhile trade-off.

For more stock ideas with similar strong fundamentals, check out the Caviar Cruise Screener.

This article is for informational purposes only and does not constitute investment advice. Always conduct your own research before making financial decisions.