Tesla stock trades at a high valuation, making future growth and innovation critical to justify its price.

Declining vehicle deliveries and political distractions pose near-term risks to Tesla’s performance.

Success in electric vehicles, robotics, and robotaxi services could unlock significant long-term upside.

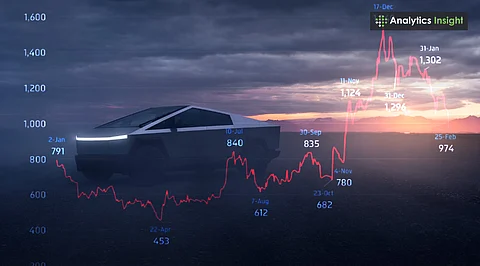

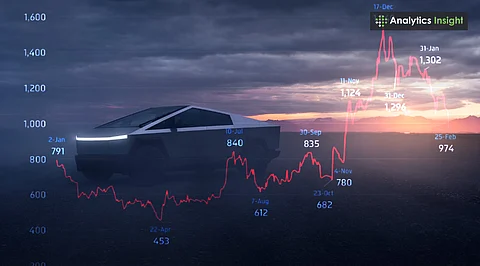

Tesla stock is trading just below $330 as of July 2025, sparking discussions among investors about whether it presents a good buying opportunity at this level. The company remains one of the most talked-about names in the stock market, known not just for its electric vehicles (EVs) but also for its ambitious work in AI, self-driving technology, and robotics. However, with recent political controversies, falling car deliveries, and a high stock valuation, the picture is more complex than it may appear at first glance.

Tesla stock is currently valued at approximately 180 times its estimated earnings for 2025. This is considered very expensive compared to most companies, which typically trade at much lower multiples. Such a high valuation means investors expect big things from Tesla in the future, whether in the form of breakthrough technology, major profits from new markets, or game-changing product launches.

Looking ahead to Tesla’s second-quarter earnings (expected soon), analysts predict revenue will fall between $22 to $22.8 billion. This would represent a drop of roughly 10–13% compared to the same quarter last year. Profits per share are also expected to fall by nearly 20%. Investors and traders are preparing for a big move in the stock price after the results, possibly swinging between $307 and $350, depending on whether the results beat or miss expectations.

Wall Street experts have mixed views about the future of Tesla stock price. Some believe that it could fall much lower, with price targets as low as $215 or even $115. These analysts argue that Tesla is overvalued, particularly given its declining vehicle sales and increasing competition from other carmakers.

On the other hand, some analysts remain positive. One well-known firm believes the stock could reach $500 if Tesla succeeds in its self-driving car efforts and expands into new markets. A more balanced group of analysts has a target price closer to $300, suggesting the stock is already trading near its fair value.

One of the main challenges Tesla stock price is facing right now is a decline in its vehicle deliveries. In the second quarter of 2025, Tesla delivered nearly 384,000 vehicles worldwide, which was 13.5% less than the same period last year. This continued drop in deliveries has raised concerns about slowing demand.

However, Tesla is expanding into new markets, including India. The company recently got approval to open its first showroom in Mumbai and plans to begin selling its Model Y vehicles there by mid-July. India, being one of the largest automobile markets in the world, could open up major growth opportunities if Tesla manages to price its cars competitively.

One vehicle that has not lived up to expectations is the Cybertruck. Although it generated excitement when it was announced, its actual production and delivery have been slow. There have also been technical issues and recalls, which have damaged its reputation among early buyers.

Tesla is not just an electric car company. It is also pushing into self-driving cars and robotics. In June 2025, Tesla began testing its robotaxi service in Austin, Texas. These cars operate in limited areas with safety drivers on board. While it’s still early days, the idea is that fully autonomous vehicles could become a big source of profit in the future.

Tesla has also shown off a humanoid robot called Optimus, which can perform simple tasks like serving popcorn. The company even opened a futuristic Tesla Diner to showcase its vision for combining technology with entertainment and convenience.

If Tesla can prove that its self-driving technology is safe and reliable, it could become one of the first companies to operate a robotaxi network. This would create a brand-new revenue stream and justify the company’s high valuation. However, current tests have had mixed results, and the U.S. government is reviewing Tesla’s early robotaxi activities for safety.

Also Read: Tesla Stock Set for New High: Golden Cross Signals Big Rally

Tesla’s CEO, Elon Musk, has recently become very active in politics. He has formed a new political party, rejoined government advisory councils, and been involved in several controversial debates. Some investors are concerned that these distractions take attention away from running Tesla.

Tesla has also faced public protests and vandalism. These actions were connected to political opinions and Musk’s role in national debates. Some people are calling for boycotts of the brand, and others have even physically attacked Tesla showrooms.

These political developments have affected the stock. For example, after a recent announcement related to Elon Musk’s new political group, Tesla stock fell by more than 7% in premarket trading. Investors are worried that public controversies could hurt the company’s reputation and sales.

Tesla is also facing challenges from new government policies. A recent change in U.S. law removed the $7,500 tax credit that electric car buyers used to receive. Without this incentive, Tesla’s cars have become more expensive, which could reduce demand.

There are also proposals to change rules around zero-emission vehicles, which could affect Tesla’s ability to earn government credits for its clean cars. These credits have been an important source of income for the company in the past years.

Some market experts now believe Tesla’s stock could fall below $200 if these policy changes lead to weaker sales and tighter profit margins.

Despite these risks, Tesla stock price prediction expects a rise in the future:

If Tesla’s second-quarter earnings beat expectations, it could lift the stock price.

Any progress in robotaxi services or AI technology would be a big positive.

A successful product demonstration later this year, something Elon Musk has teased, could renew excitement about Tesla’s innovation.

Early sales numbers from India could signal strong demand in new markets.

Expansion into other regions like Latin America could further boost revenue.

However, the road ahead is not without risks:

Slowing car sales could continue to hurt revenue.

Tesla’s high stock price makes it vulnerable if earnings or guidance disappoint.

Political issues and public backlash could harm the brand’s image.

Self-driving technology still faces legal, technical, and safety challenges.

Changes in government policy could reduce profit margins and customer demand.

Also Read: Tesla Stock: Is it a Good Time to Buy?

The answer depends on the type of investor. For those focused on long-term growth and willing to take risks, Tesla offers exciting potential. If robotaxis and other technologies succeed, the company could become much more valuable in the coming years.

On the other hand, conservative investors might find Tesla’s current price too high, especially given the company’s falling sales and political distractions. Those investors may prefer to wait for a lower entry point or clearer signs of recovery.

One approach could be to buy in small amounts below $330 and add more if Tesla meets important milestones. Ultimately, Tesla remains one of the most distinctive companies in the market, but with high potential comes high risk.

Join our WhatsApp Channel to get the latest news, exclusives and videos on WhatsApp

_____________

Disclaimer: Analytics Insight does not provide financial advice or guidance on cryptocurrencies and stocks. Also note that the cryptocurrencies mentioned/listed on the website could potentially be risky, i.e. designed to induce you to invest financial resources that may be lost forever and not be recoverable once investments are made. This article is provided for informational purposes and does not constitute investment advice. You are responsible for conducting your own research (DYOR) before making any investments. Read more about the financial risks involved here.