Crypto News: Ethereum (ETH), one of the most well-known cryptocurrencies, has been generating headlines in the financial community. At the time of writing, Ethereum was trading at US$3,979. Ethereum's value has increased by 2.46% in the last 24 hours. This rising rise suggests an optimistic mood in the market.

The current price movement has had a big influence on Ethereum's market capitalization, which is now US$477.83 billion, an astounding figure. Market capitalization is the total value of all circulating Ethereum coins. This considerable amount emphasizes Ethereum's status as a prominent participant in the cryptocurrency sector.

Technical Analysis:

The technical indicators for Ethereum as of the most recent data are as follows: The RSI (14) is at 62.72, suggesting an overbought position. The MACD value is 48.3, and a bullish histogram at 54.3. The Support and resistance level, with the support of US$3205.9 and resistance of US$4003.3. These indicators give information about the current market mood and prospective patterns in Ethereum's price movement.

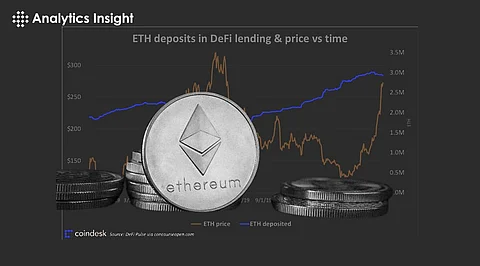

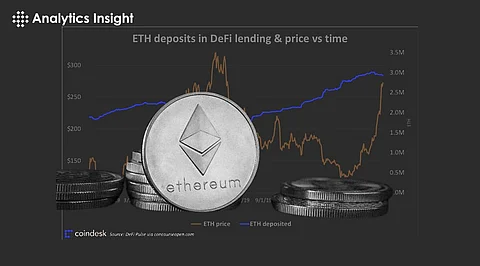

Demand and supply dynamics are one of the key factors influencing the price of ETH. A portion of ETH fees is burned with every block, creating scarcity and increasing its value. Furthermore, ETH is in great demand from a variety of sources, including:

Based on the information shown above, we can infer that ETH has a positive long-term prognosis. ETH has a strong and rising demand from a variety of industries and use cases, a restricted and diminishing supply that produces scarcity and value, a big and active community that fosters network effects and creativity, and ongoing development and improvement that strengthens its technology and features. These characteristics contribute to ETH's long-term development potential, establishing it as a prominent and important platform in the cryptocurrency and blockchain field.

• According to Forbes Advisor India, the price of Ethereum is predicted to increase to US$5,000 by the end of 2024, US$6,500 by the end of 2025, and US$20,500 by the end of 2030.

• According to Changelly, the price of Ethereum is predicted to reach US$7,283 by the end of 2025 and US$44,067 by the end of 2030.

• According to Benzinga, the price of Ethereum is predicted to reach US$9,860.94 by the end of 2025 and US$20,500 by 2030.

Join our WhatsApp Channel to get the latest news, exclusives and videos on WhatsApp

_____________

Disclaimer: Analytics Insight does not provide financial advice or guidance. Also note that the cryptocurrencies mentioned/listed on the website could potentially be scams, i.e. designed to induce you to invest financial resources that may be lost forever and not be recoverable once investments are made. You are responsible for conducting your own research (DYOR) before making any investments. Read more here.