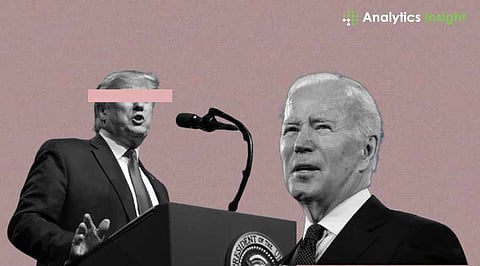

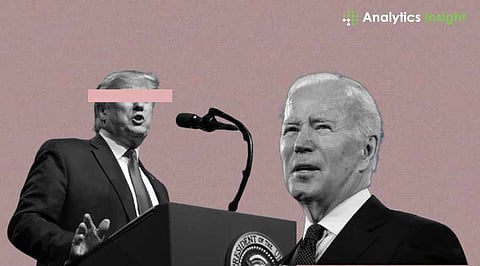

The cryptocurrency landscape in the United States has been shaped by contrasting approaches from Presidents Donald Trump and Joe Biden. Their strategies have influenced regulation, market sentiment, and the broader acceptance of digital assets. With President Trump returning to office in January 2025, the crypto industry has seen a significant shift in policy, with deregulation and government-backed crypto initiatives taking center stage. Meanwhile, Biden’s tenure focused on a strict regulatory framework, aiming to integrate cryptocurrencies within traditional financial structures while ensuring consumer protection and financial stability.

This article explores the key differences in their crypto policies, their impact on the market, and how the industry has responded.

After taking office in January 2025, President Trump reversed his earlier skepticism toward cryptocurrencies and adopted a more favorable stance. His administration introduced several initiatives aimed at integrating crypto into the national financial system while promoting blockchain innovation.

Signed in January 2025, this order focused on strengthening U.S. leadership in blockchain and cryptocurrency markets.

Established a crypto working group to propose regulations that encourage innovation.

Proposed a national cryptocurrency stockpile, aimed at reserving digital assets as part of U.S. financial reserves.

Proposed easier access to banking services for crypto businesses.

Reduced restrictions on crypto exchanges and investment firms handling digital assets.

Encouraged Bitcoin mining in the U.S. to ensure American dominance in the sector.

The administration hosted high-profile crypto events, such as the “Crypto Ball,” attended by industry leaders and politicians.

David Sacks, a known advocate for digital assets, was appointed as AI and crypto policy head in the administration.

Following the 2024 election results, Bitcoin surged over 55%, crossing the $100,000 mark for the first time.

Institutional investors, hedge funds, and retail traders welcomed the pro-crypto policies.

Crypto exchanges saw increased trading volume and investment in blockchain projects soared.

However, concerns remain regarding market stability, as deregulation can increase volatility and risk of financial manipulation in crypto markets.

President Joe Biden's administration took a more cautious approach to cryptocurrency, emphasizing financial stability and regulatory oversight. While not completely anti-crypto, Biden’s policies focused on preventing fraud, ensuring transparency, and integrating crypto within existing financial regulations.

Executive Order on Digital Assets (2022)

Established a federal strategy to regulate digital assets.

Focused on consumer protection, anti-money laundering (AML) compliance, and financial crime prevention.

Called for greater cooperation with global regulators to manage cross-border crypto transactions.

The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) launched investigations into multiple crypto firms.

Companies like Binance and Coinbase faced increased scrutiny, leading to regulatory lawsuits and stricter compliance requirements.

Pushed for stablecoins to be backed 1:1 with fiat reserves, limiting the issuance of algorithmic stablecoins.

Ensured that stablecoin issuers were licensed financial institutions.

Introduced strict reporting requirements for crypto transactions over $10,000.

Imposed capital gains tax on digital assets, making crypto trading more expensive for retail investors.

Bitcoin and major altcoins experienced increased volatility due to regulatory uncertainty.

Institutional investors reduced their exposure to digital assets, waiting for clearer guidelines.

Some crypto firms moved offshore, setting up operations in crypto-friendly countries like Dubai and Singapore.

While Biden’s approach ensured security, critics argue that overregulation stifled innovation, making it difficult for startups and investors to thrive in the U.S. crypto sector.

The crypto industry has largely welcomed Trump’s return due to his pro-business, anti-regulation stance. Some major figures have spoken in favor of his policies:

Coinbase CEO Brian Armstrong expressed relief, citing that clearer regulatory frameworks could boost crypto adoption.

Crypto billionaires like the Winklevoss twins have praised the shift toward crypto-friendly policies.

Major crypto hedge funds have re-entered the market, increasing their holdings in Bitcoin and Ethereum.

Meanwhile, critics argue that Trump’s deregulation could lead to financial instability, citing concerns over market manipulation and fraud risks.

The U.S. crypto industry is entering a new era of deregulation under Trump. While investors celebrate the market-friendly policies, regulatory bodies like the SEC and CFTC may push back, seeking to maintain some level of oversight.

Trump’s administration is exploring the idea of a Bitcoin-backed reserve to strengthen the U.S. dollar.

Companies like BlackRock and Fidelity are preparing Bitcoin ETFs, expecting looser regulatory hurdles under Trump.

Deregulation may boost prices short term, but the lack of oversight could create sudden price swings.

The administration wants the U.S. to compete with Dubai and Singapore as a global crypto capital.

The Trump vs. Biden debate on crypto comes down to regulation vs. free markets.

Trump’s strategy focuses on deregulation, economic growth, and institutional adoption, leading to short-term market excitement but increased volatility.

Biden’s approach ensured consumer protection, regulatory oversight, and integration with traditional finance, but stifled innovation and drove some firms offshore.

With Trump back in office, crypto is entering a pro-business phase, but long-term stability remains uncertain. Investors should keep an eye on future regulatory battles, Bitcoin adoption trends, and the evolving global crypto landscape.