Application Programming Interface (API) helps the 3rd party application to use a particular interface that can be accessed via a common set of services and tools.

The use of API helps banks to connect with diversified financial institutions, digital platforms, and third-party apps.

Let’s study the role of API and the detail of it in this blog.

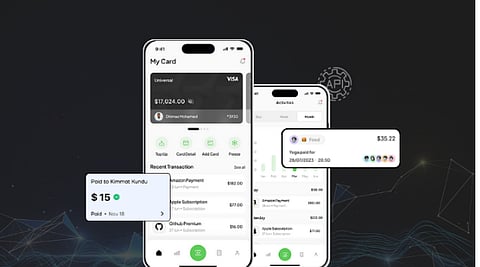

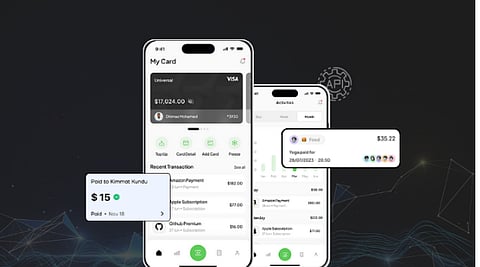

To enhance the mobile banking experience, it is important to implement the API as a feature in the app.

Additionally, if you have your banking business software in the market and want to update it with APIs, connecting with eWallet app development services provider can be beneficial.

Now, let’s study the role of APIs in enhancing the mobile banking experience of the target users.

APIs help in ensuring encryption techniques to secure the differentiated data that is transmitted among clients and servers. You can ensure the confidentiality and integrity of the information that is being exchanged in transit.

For developing secure APIs, robust security controls are significant. Additionally, you can utilize authorization controls for defining and enforcing access rights.

This feature ensures that the data is transmitted between the financial systems and cannot be read by hackers.

You can improve the customer experience of the users and can effectively go for banking, insurance, wealth management, and more.

When customers have an easy path to secure, accurate information, then users can achieve their desired objectives easily.

The banks can effectively deliver the solution for meeting the user’s needs and API helps them to access the banking information and details about their accounts easily.

With the assistance of API, you can provide access to any kind of data along with third-party applications that banks use, it is essential that the applications needed to be communicating with each other.

Well, with the assistance of API, the users can improve their efficiency as well as enhance their revenue.

Additionally, API can be useful in enhancing revenue by providing access to the data and improving customer experience.

APIs are effective in integrating new applications within the software. This further leads to the enhancement of the development speed because every functionality needs not to be written from scratch.

With the help of integration, the banks can improve their services for the target users. It enables enterprises to synch the tools so that the data can move between them, creating a single source of consistent, reliable, and accurate data.

It helps teams consolidate the data from diversified sources and makes it easier to analyze the complete data.

Automation is one of the important benefits to look for that assist in describing a wide range of technologies, which assist in reducing the human intervention procedure.

Building an API in banking apps will lead to less effort, if required when you use an API that is managed by the computers. A well-known mobile banking app development company wisely knows the value of implementing automation.

A steady stream of new content and information can be published on the fly in real time. Additionally, this can be published and shared with the entire audience quickly as well as efficiently across all the channels.

API can be helpful to the developers to become more productive through reusing the code within complex but a repetitive procedure.

The feature is effective in assembling software components within the program. With the assistance of API, you can easily connect diversified applications.

With the assistance of API, the developers can become innovative for successfully leading the industry. The feature can be used successfully to enhance the user’s skills to operate the banking app wisely.

Through accepted programming standards including REST and Open API, the developers can use APIs to place an increased emphasis on security. The open architecture assists in providing security, via monitoring and improving technical features.

With the assistance of API security, developers can protect the personal data of the users such as login credentials along with financial information, from hackers.

API can effectively use signatures and Security Assertion Markup (SAML) tokens for authenticating and authorization of messages that get transferred. Through the digital lock, API can help access sensitive details and ensure data protection.

APIs in fintech can help enhance the functions of the project and reach the aim.

You can use the standards including REST and Open API within the applications to create new business opportunities.

Through accessibility and modularity, you can add increased functionality to the interface development and fulfill its purpose.

The implementation of APIs can help secure data, improve functional portability, enhance developers’ efficiency and innovation, and provide integration and automation. This further leads to enhancing customer experience and securing data access.

With the assistance of APIs in the banking apps, the users can secure their data and may trust the app to share their information. This results in developing strong relations with the brand.

Join our WhatsApp Channel to get the latest news, exclusives and videos on WhatsApp

_____________

Disclaimer: Analytics Insight does not provide financial advice or guidance on cryptocurrencies and stocks. Also note that the cryptocurrencies mentioned/listed on the website could potentially be risky, i.e. designed to induce you to invest financial resources that may be lost forever and not be recoverable once investments are made. This article is provided for informational purposes and does not constitute investment advice. You are responsible for conducting your own research (DYOR) before making any investments. Read more about the financial risks involved here.